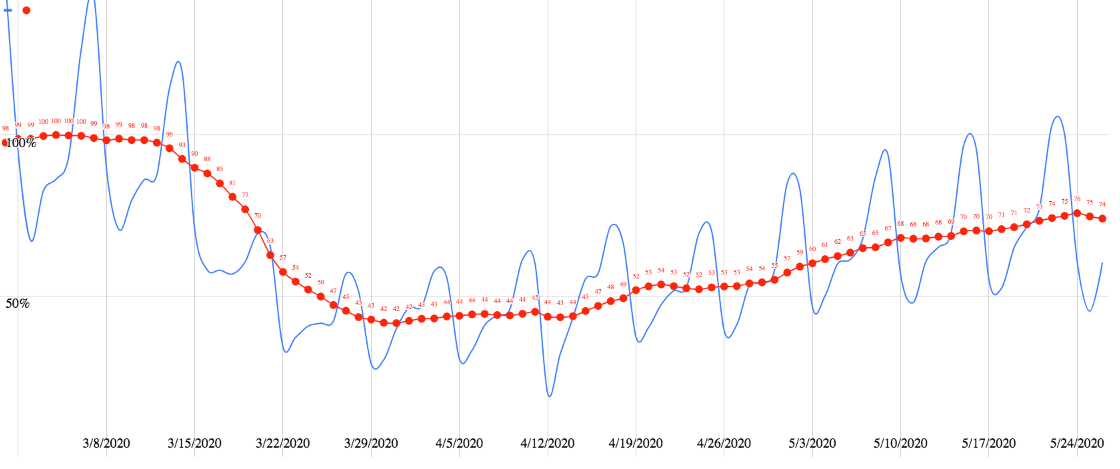

Main Street Retail Sales Have Been Improving Since March 31st

This chart shows brick-and-mortar merchants’ daily sales revenue since early March and then a rolling 7-day average of those sales. The high point of the red line was on March 5th, 2020 while the low point of the red line occurred on March 31st, 2020. At that point, sales revenue had crashed by over 58% in just a few weeks. Now it’s down by 26% and steadily improving to a busy Memorial Day weekend.

Read more